Centralized Augmented Reality (AR), Virtual Reality (VR), Mixed Reality (MR), Metaverse, Extended Reality (XR) and Spatial Computing Industry Statistics & Analysis - 2026

Executive Summary

The AR, VR, XR, MR, Metaverse and Spatial Computing industry is experiencing strong growth across multiple market segments, with projections showing significant expansion through 2030. This industry market shows strong enterprise adoption, evolving XR hardware ecosystems, and regional growth led by Asia-Pacific's manufacturing capabilities and North America's innovation base.

What You Need to Know:

Global XR market projected to reach $85.56 billion by 2030 (33.16% CAGR)

Enterprise adoption driving 60% of total industry revenue by 2030

Meta dominates hardware shipments with 74.6%-77% market share

Asia-Pacific fastest growing region (35.1% CAGR through 2030)

Overview of the Spatial Computing / Extended Reality (XR) Industry

The spatial computing or extended reality (XR) industry represents a convergence of technologies that enable humans to interact with computers in three dimensional space, creating immersive digital experiences that are transforming how we work, learn, and interact. This rapidly evolving technology sector encompasses multiple overlapping technologies, each with distinct characteristics but collectively driving toward a future where digital content seamlessly integrates with our physical environment.

What Counts as AR, VR, MR, XR, Metaverse and Spatial Computing

Spatial Computing refers to the broader technological category that enables digital content to exist and interact within three-dimensional space, using spatial sensors, displays, cameras, artificial intelligence, and machine learning to understand and map physical environments. It encompasses XR technologies while also including augmented reality, virtual reality and mixed reality systems.

Extended Reality (XR) serves as a synonym umbrella term to spatial computing, encompassing all immersive technologies: VR, AR, and MR.

Virtual Reality (VR) creates fully immersive digital simulations that completely replace the user's view of the real world, typically through head-mounted displays that block out physical surroundings. Users interact within computer-generated 3D spaces for gaming, training simulations, and virtual experiences.

Augmented Reality (AR) overlays digital content onto the real world, enhancing users' perception of their physical environment through smartphones, head mount displays or specialized smart glasses. Augmented reality maintains full awareness of real-world surroundings while adding contextual digital information, objects, or interfaces.

Mixed Reality (MR) refers to environments where physical and digital content interact in real time. Often described as a continuum between Augmented Reality (AR) and Virtual Reality (VR), MR blends elements of both. The term covers a wide range of experiences, from fully virtual spaces to light augmented overlays anchored in real environments.

Metaverse, as defined by Meta Platforms, refers to a collective virtual shared space created by the convergence of virtually enhanced physical reality and physically persistent virtual space, including the sum of all virtual worlds, augmented reality, and the internet. This definition emphasizes an interconnected, immersive digital environment where people can interact, work, and play in real-time, transcending traditional digital boundaries.

Why Industry Statistics Matter

Accurate industry statistics are crucial for understanding the true trajectory and potential of spatial computing technologies and the global spatial computing market. These metrics provide essential insights for investors evaluating market opportunities, enterprises planning technology adoption strategies, and policymakers considering regulatory frameworks.

Market Size & Growth Projections

The spatial computing market is experiencing high growth across all major market segments, with projections indicating explosive expansion through the end of this decade. Multiple research firms consistently forecast compound annual growth rates exceeding 30% across various XR categories, driven by enterprise adoption, technological advancements, and expanding use cases beyond traditional gaming applications.

Overall Market Valuations

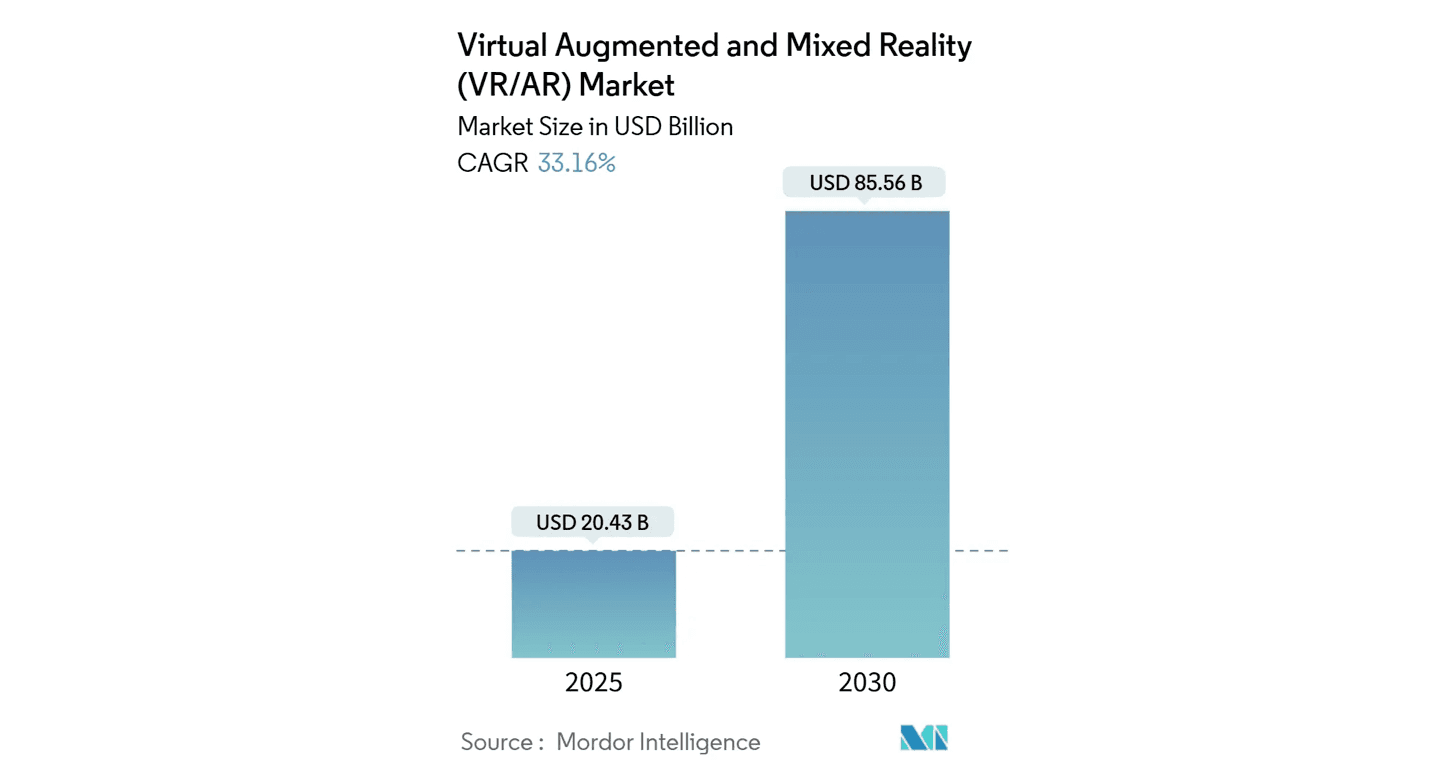

The combined virtual, augmented, and mixed reality market represents one of the fastest-growing technology sectors globally. According to Mordor Intelligence, the spatial computing market size is projected to surge from $20.43 billion in 2025 to $85.56 billion by 2030, representing a 33.16% compound annual growth rate (CAGR). This growth trajectory reflects the technology's evolution from pilot applications to production ready business tools across healthcare, manufacturing, education, and training sectors.

Key Statistics: Virtual, Augmented and Mixed Reality Combined Market:

2025: $20.43 billion

2030 Conservative Estimate: $85.56 billion (33.16% CAGR from $20.43B in 2025)

2030 Higher Estimate: $200.87 billion by 2030 (22.0% CAGR from $59.76B in 2024)

Segment-Specific Projections

Within the broader spatial computing ecosystem, specific technology segments demonstrate varying growth patterns and market dynamics. Virtual reality, while representing a smaller market in absolute terms compared to the combined projections above, shows strong momentum driven by gaming, training, and enterprise applications.

Key Statistics: Virtual Reality Market:

2024: $16.32 billion

2025: $20.83 billion

2032: $123.06 billion

CAGR: 28.9%

The specialized AR and VR training market represents one of the fastest-growing applications within the broader XR ecosystem. This vertical-specific market demonstrates the strong enterprise adoption driving overall industry growth, with organizations implementing immersive technologies for workforce development across multiple sectors.

Key Statistics: AR and VR in Training Market:

2025: $22.56 billion

2034: $82.92 billion

CAGR: 15.56%

These segment-specific projections align logically with the overall market range of $85-200 billion by 2030, with VR representing a significant portion of the combined market and training applications demonstrating strong vertical-specific growth within the broader ecosystem.

Hardware Market & Device Shipments

The spatial computing hardware market represents the foundation of the spatial computing ecosystem, with device manufacturers competing intensely for market share while navigating supply chain challenges and evolving consumer preferences. Recent data reveals significant shifts in vendor positioning, with established players like Meta Platforms maintaining dominance while new entrants like XREAL demonstrate rapid growth in emerging categories like smart glasses.

Market Share Leaders & Growth Trends

The first quarter of 2025 marked a significant milestone for the AR/VR hardware market, with global headset shipments growing 18.1% year-over-year despite broader technology sector challenges. Meta Platforms' position evolved during this period, holding 50.8% market share in Q1 2025, representing a shift from its previously dominant position as the market becomes more competitive. XREAL emerged as a notable challenger, capturing 12.1% market share in the same quarter, demonstrating the rapid growth potential for companies focused on lightweight AR glasses and enterprise applications.

Key Statistics - Q1 2025:

Global AR/VR headset market grew 18.1% YoY in Q1 2025

Meta Platforms held 50.8% share that quarter

XREAL captured 12.1% market share in Q1 2025

Full-year 2024 data provides additional context for understanding market dynamics, with Meta Platforms maintaining a commanding 74.6% share across the entire year. This dominance reflects the company's operating system and software ecosystem approach, combining hardware, software, and content in an integrated platform. Apple's entry with the Vision Pro secured 5.2% market share despite its premium positioning and price, while established gaming-focused players like Sony Corporation maintained steady market presence with 4.3% share through PlayStation VR2 sales.

Key Statistics - Full-Year 2024 Vendor Share (Units):

Meta Platforms: 74.6%

Apple: 5.2%

Sony Corporation: 4.3%

ByteDance: 4.1%

XREAL: 3.3%

Shipment Volumes & Market Trends

The 2024 hardware market demonstrated resilience despite economic uncertainties, with global AR/VR headset shipments reaching 9.6 million units and achieving growth rates between 8.8% and 10% year-over-year across different measurement methodologies. This growth was supported by component-level improvements, as AR/VR display panel shipments increased 12% in 2024 according to DSCC, a Counterpoint company. Meta Quest continued driving market expansion with 11% year-over-year shipment growth, validating the company's strategy of offering multiple price points and regular hardware updates.

Key Statistics - 2024 Performance:

Global AR/VR headset shipments: 9.6 million units

Growth: 8.8%-10% YoY

AR/VR display panels shipments +12% in 2024

Meta Quest shipments up 11% YoY

Industry forecasts predict a temporary market contraction in 2025, with shipments expected to decline approximately 12% due to delayed product launches from major manufacturers. However, this near-term challenge is expected to give way to substantial recovery in 2026, with analysts projecting approximately 87% growth as new product cycles resume and accumulated demand is released. The longer-term outlook remains strongly positive, with a 38.6% compound annual growth rate anticipated for units shipped between 2025 and 2029.

Key Statistics - 2025-2026 Forecast:

2025 shipments expected to decline ~12% due to delayed launches

2026 rebound expected with ~87% growth

2025-2029 CAGR: ~38.6% (units)

Regional spending patterns provide additional insight into market development, with EMEA (Europe, Middle East, and Africa) AR/VR spending forecast to reach $8.4 billion by 2029 according to IDC's Spending Guide. This projection reflects growing enterprise adoption across European markets and increasing government support for digital transformation initiatives incorporating immersive technologies.

Key Statistics - EMEA Regional Market:

EMEA AR/VR spending forecast to reach $8.4B by 2029

Smart Glasses & AI Glasses

The smart glasses category represents the most dynamic segment within the broader XR hardware market, demonstrating explosive growth that signals a potential paradigm shift toward more socially acceptable form factors. The first half of 2025 witnessed impressive momentum, with smart glasses shipments surging 110% year-over-year, driven primarily by AI-enabled features and improved industrial design that addresses previous generations' limitations around battery life, weight, and social acceptance.

Key Statistics - H1 2025 Smart Glasses Performance:

H1 2025 smart-glasses shipments +110% YoY

78% were AI smart glasses

Meta Platforms held >70% share of smart glasses market

Meta Platforms' Ray-Ban partnership exemplifies the potential for mainstream smart glasses adoption when technology companies collaborate with established fashion brands. Since launching in October 2023, Ray-Ban Meta glasses have sold more than 2 million units, with sales tripling in the second quarter of 2025 according to reports from Wired and corroborating commentary from EssilorLuxottica's earnings calls. This success demonstrates consumer willingness to adopt wearable AR technology when packaged in familiar, stylish form factors.

Key Statistics - Ray-Ban Meta Success:

>2 million units sold since October 2023

Sales tripled in Q2 2025

In contrast to the smart glasses surge, Apple's Vision Pro experienced post-launch momentum challenges typical of first-generation premium products. After an initial launch quarter driven by early adopter enthusiasm, Vision Pro shipments fell 43% quarter-over-quarter in Q4 2024. Full-year estimates suggest Apple sold approximately 370,000 to 420,000 Vision Pro units in 2024, representing a solid foundation for a first-generation mixed reality headset that was launched as an early-adopter targeted premium device.

Key Statistics - Apple Vision Pro Performance:

Estimated ~370k–420k Vision Pro units sold in 2024

Content & Developer Economics

The content and developer ecosystem represents the critical bridge between hardware capabilities and user engagement, with platform owners investing billions in content creation while developers seek sustainable monetization models. Recent data from major platforms reveals significant momentum in both content consumption and creator revenue, suggesting the industry may be approaching a sustainable content economy that can support long-term ecosystem growth.

Meta Quest Ecosystem Performance

Meta Platforms' Quest platform has emerged as the dominant content ecosystem in VR, demonstrating sustained growth in both user engagement and developer monetization. The platform has achieved a significant milestone with over $2 billion spent on Quest titles to date, representing substantial progress toward building a sustainable content marketplace. As of 2026, there are more than 4,000 titles in the Meta Store. This spending reflects both the growing user base and increasing willingness to pay for premium VR experiences as content quality and variety improve.

Key Statistics - Developer Revenue & Engagement (2024):

Over $2B has been spent on Meta Quest titles to date

Developer payments increased 12% in 2024

Monthly time in VR increased 30% YoY in 2024

Meta Platforms' investment in content creation through its Oculus Publishing initiative shows the platform's commitment to building a continued content pipeline. The company funded and shipped over 100 titles in 2024 alone, while maintaining a development pipeline of more than 200 titles currently in production. This aggressive content strategy reflects Meta's understanding that hardware adoption ultimately depends on compelling software experiences.

Key Statistics - Content Production Pipeline:

Meta's Oculus Publishing: 100+ funded titles shipped in 2024

200+ titles currently in production

Apple Vision Pro Ecosystem

Apple's entry into spatial computing brought its characteristic focus on curated, high-quality experiences, though adoption has been limited by the device's premium positioning and early-generation constraints. The Vision Pro ecosystem achieved over 2,000 native visionOS apps by June 2024, reflecting strong developer interest despite the platform’s small user base. However, most of these apps are legacy 2D-style applications, with only an estimated 500 truly spatial apps designed around the new 3D spatial paradigm. The platform faces the classic chicken-and-egg challenge of encouraging developers to build fully spatial experiences without broad consumer adoption in place.

Key Statistics - Apple Vision Pro Ecosystem:

Estimated ~370k–420k Vision Pro units sold in 2024

>2,000 visionOS apps available by June 10, 2024

An estimated fewer than 500 visionOS apps are true native spatial applications

Enterprise Adoption & Training

Enterprise adoption represents the most promising near-term growth driver for spatial computing technologies, with organizations increasingly recognizing measurable returns on investment (ROI) from immersive training, guided work, data visualization, digital twins, prototyping and collaboration applications. Unlike consumer markets, where adoption remains challenged by content limitations and social acceptance issues, enterprise deployments demonstrate clear ROI, productivity benefits and cost savings that justify technology investments.

Enterprise XR Adoption Statistics

The Fortune 500 has emerged as a leading indicator for enterprise XR adoption, with 75% of these companies having adopted VR for training and education purposes. This widespread corporate acceptance reflects the maturation of VR technology and its proven effectiveness in scenarios requiring hands-on learning, safety training, and complex procedure simulation. Industry projections suggest enterprise users will drive 60% of total VR revenue by 2030, representing a fundamental shift from gaming-dominated revenue models to business-focused applications.

Key Statistics - Fortune 500 Adoption:

Over 75% of Fortune 500 companies have adopted XR through pilot programs or production use

Enterprise will drive 60% of total VR revenue by 2030

Commercial shipments grew 14.9% in 2024

Training Effectiveness & Corporate Implementation

Corporate training represents one of the most data-rich applications for measuring XR effectiveness, with organizations tracking specific metrics around learning outcomes, time-to-competency, and cost reduction. Recent surveys reveal that while overall organizational volume of adoption remains modest, large companies are significantly more likely to implement immersive training solutions at scale. VR is currently actively used by 7% of organizations overall for training delivery, but this figure jumps to 22% among large enterprise companies, indicating that scale and resources facilitate successful XR implementation.

Key Statistics - Training Delivery Methods (2024):

VR actively used in training by 7% of organizations overall

VR actively used in training by 22% of large enterprise companies

AR used by 4% of organizations

Industry studies show VR training effectiveness provides some of the most compelling evidence for immersive learning's advantages over traditional methods. The research demonstrates that VR learners completed training programs four times faster than classroom instruction and remained four times more focused than e-learning participants. Perhaps most significantly, VR-trained participants showed 3.75 times more emotional connection to training content and up to 275% more confidence in applying newly acquired skills. When implemented at scale, VR training can achieve 52% cost reduction compared to traditional classroom instruction.

Key Statistics - XR for Training Study Results:

Learners completed training 4× faster than classroom

4× more focused than e-learners

3.75× more emotionally connected to content

Up to 275% more confident applying skills

At scale, VR can be 52% less costly than classroom training

Leading corporations across multiple industries have documented specific productivity improvements from VR training implementation. Boeing achieved a 75% reduction in training time per employee through VR-based assembly training, while Airbus reported 25% faster maintenance task performance compared to traditional CATIA and DMU training methods. Delta Airlines transformed its technician training program, increasing daily proficiency checks from 3 to 150 per day, a remarkable 5,000% improvement in training throughput.

Key Statistics - Corporate Success Stories:

Boeing: 75% reduction in training time per person

Airbus: 25% faster maintenance performance vs traditional methods

Delta Airlines: Boosted technician proficiency checks from 3 to 150 per day (5,000% increase)

Healthcare sector: 40% fewer surgical mistakes with VR training

Manufacturing: 43% reduction in workplace injuries

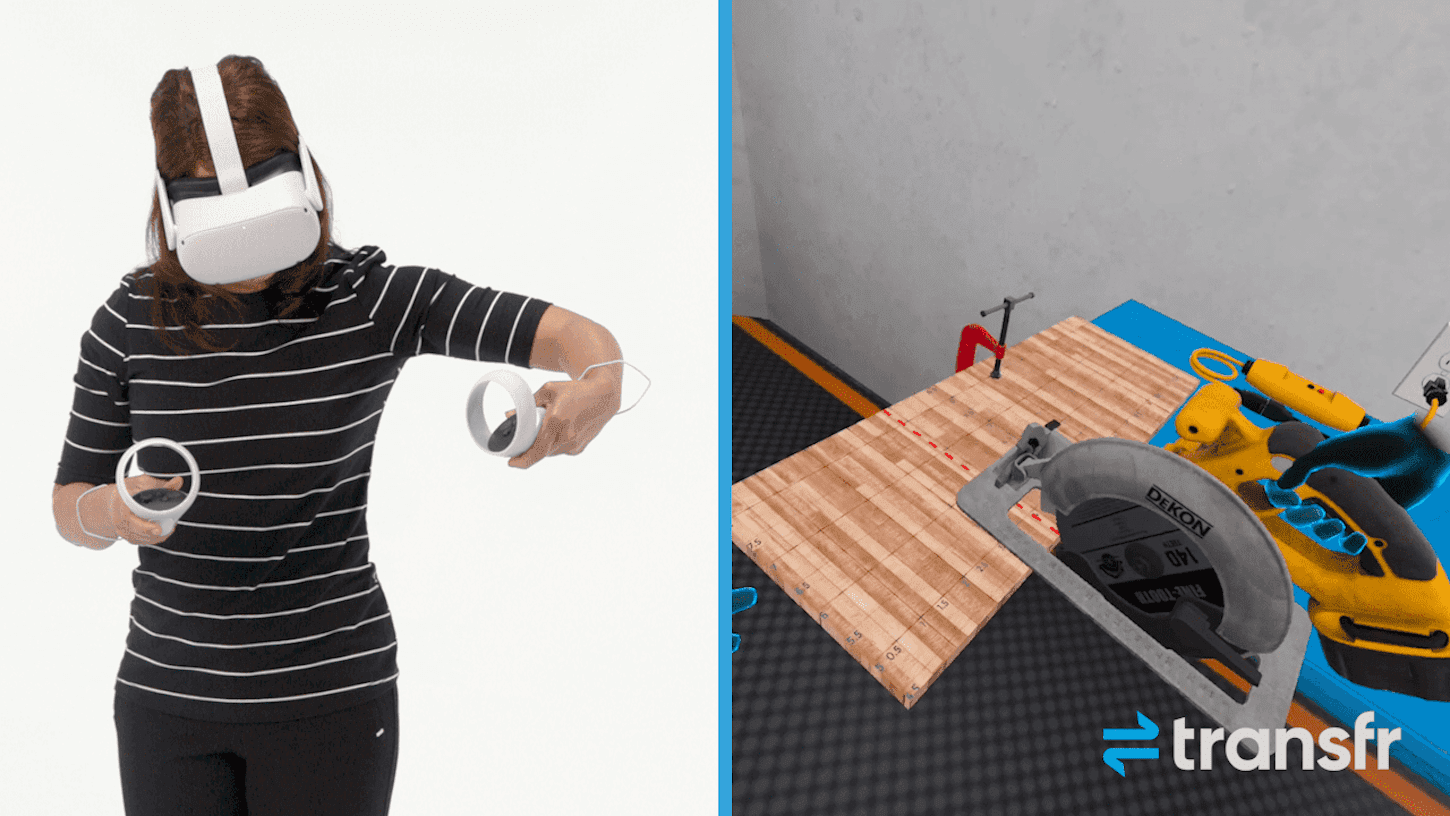

Skilled Trades Training Breakthroughs

Beyond corporate environments, VR training has demonstrated exceptional effectiveness in skilled trades education, addressing critical workforce development challenges in high-demand technical careers. Recent controlled studies reveal that VR can accelerate skill acquisition to levels that traditionally require months of hands-on experience, while providing safe learning environments for potentially hazardous tasks.

Industry research across multiple trades demonstrates VR's ability to elevate novice learners to performance levels typically achieved by workers with moderate real-world experience. In automotive maintenance training, VR-educated beginners performed statistically similar to intermediate-level technicians who received traditional video instruction, effectively compressing the learning curve from months to hours.

Key Statistics - Skilled Trades VR Training Effectiveness:

Oil Change Training: VR-trained novices performed statistically similar to intermediate-level workers with video training

Electrical Construction: VR training showed superior knowledge retention compared to passive video learning

Blood Pressure Training: VR group achieved 78% learning gain vs. 44% for traditional slides (78% improvement)

Respirations Training: VR group achieved 50% learning gain vs. 31% for slides (61% improvement)

Pain Assessment: VR group achieved 47% learning gain vs. 30% for slides (57% improvement)

Temperature Assessment: VR group achieved 37% learning gain vs. 25% for slides (48% improvement)

Construction education research provides additional validation of VR's effectiveness in trades training. The National Center for Construction Education and Research (NCCER), in partnership with Associated Builders and Contractors of Illinois, conducted controlled studies comparing traditional lab instruction with VR-enhanced learning. Students using VR simulations for circular saw and electric drill training reported significantly higher engagement levels and practical understanding of safety protocols.

Key Statistics - Construction Training Studies:

NCCER Construction Study: Students reported significantly higher engagement and confidence with VR vs. traditional lab training

Arkansas State Study: 67% of students reported increased confidence, 71% reported positive change in perceived learning

Active vs. Passive Learning: Active VR participation showed statistically superior learning gains vs. passive video watching

Cross-Age Adoption: 90% of users aged 60+ successfully adapted to VR training despite no prior experience

The psychological benefits of VR training extend beyond knowledge acquisition to confidence building and engagement enhancement. Students consistently report that VR training provides realistic job previews that help them understand workplace expectations before entering the field. This preparatory aspect addresses a critical gap in traditional trade education, where students often struggle to connect classroom theory with real-world application.

Key Statistics - Student Engagement and Confidence:

Focus Improvement: Students "put their phones down" and completed modules "without distraction" during VR training

Self-Efficacy: VR training participants reported increased self-efficacy compared to traditional methods

Real-World Connection: Students reported better understanding of "what to expect on the job" through VR simulations

Retention Advantages: VR training showed superior knowledge retention over time compared to traditional instructional methods

Industry-Specific Adoption

Healthcare represents one of the most promising vertical markets for AR/VR adoption, with applications spanning medical training, patient treatment, and surgical planning. The healthcare AR market has grown from approximately $610 million in 2018 to projected levels exceeding $4.2 billion by 2026. Current adoption shows 40% of healthcare providers using VR for patient treatment and staff training, indicating significant momentum toward mainstream healthcare innovation and integration.

Key Statistics - Healthcare Industry:

2018 AR market: $610 million

2026 projection: $4.2 billion

40% of healthcare providers using VR for patient treatment/staff training

Educational institutions have similarly embraced immersive technologies, with 30% of universities worldwide now offering VR-based courses as of 2024. This adoption has been supported by Meta Platforms' focused push into the education segment, which drove 69.4% growth in educational VR deployments during 2024, contributing to overall commercial shipment growth of 14.9%.

Key Statistics - Education:

30% of universities worldwide offering VR-based courses in 2024

Education segment grew 69.4% in 2024

Manufacturing and industrial applications demonstrate strong ROI metrics for AR/VR implementation. The economic value of AR IoT in manufacturing is projected to reach $40-50 billion by 2025, expanding to $90-110 billion by 2030. Survey data shows that 75% of industrial companies implementing large-scale VR and AR technologies report 10% operational efficiency improvements, providing clear justification for continued investment.

Key Statistics - Manufacturing & Industrial:

Economic value of AR IoT in manufacturing: $40-50 billion by 2025, $90-110 billion by 2030

75% of industrial companies implementing large-scale VR/AR report 10% operations increase

Investment & Funding Landscape

The investment landscape for spatial computing reflects both the massive potential and risks of emerging technologies, with funding patterns showing swings between periods of intense interest and market correction. Corporate investment from major technology companies continues at unprecedented levels, while venture capital activity has cooled from pandemic-era peaks as investors seek more sustainable business models and clearer paths to profitability.

Corporate Investment

Meta's commitment to spatial computing represents the largest sustained technology investments in recent corporate history. The company allocates approximately 20% of its total budget to Reality Labs, its XR division, representing roughly $20 billion in annual investment. This massive spending is distributed across hardware development, software platforms, content creation, and fundamental research, with more than half dedicated specifically to augmented reality development as the company positions for the next computing platform transition.

Key Statistics - Meta Reality Labs Spending:

Meta invests ~$20 billion annually in XR

20% of Meta Platforms' total budget allocated to Reality Labs

Over 50% of Reality Labs spending goes to AR development

Cumulative losses: $60 billion since 2020

Q4 2024 XR hardware revenue: $1.1 billion

Venture Capital Activity

Venture capital investment in XR technologies peaked during the 2021-2022 period, reflecting broader technology sector enthusiasm and significant investor interest in metaverse-related opportunities. The sector achieved its second-best year ever in 2021 with $3.9 billion in venture funding, trailing only the record $4.4 billion invested in 2018. The fourth quarter of 2021 set a single-quarter record with $1.9 billion in venture capital flowing to VR/AR startups, driven by high-profile rounds and increased institutional investor interest.

Key Statistics - Historical Investment Peaks:

2021: $3.9 billion (second-best year ever)

2018: $4.4 billion (best year on record)

Q4 2021: $1.9 billion (record quarter)

However, venture investment has retreated significantly from these peaks as market realities have tempered investor enthusiasm. By the third quarter of 2022, metaverse-related funding had declined to approximately $760 million, representing a substantial correction from peak levels. This cooling reflects broader challenges including slower-than-expected consumer adoption, technical limitations of current hardware, and questions about sustainable business models in consumer VR markets.

Key Statistics - Recent Trends:

Q3 2022: $760 million

Investment cooling due to slower consumer market adoption rates

Focus shifting to AI-enabled applications

Notable Recent Deals

Despite overall market cooling, strategic partnerships and enterprise-focused investments continue attracting significant funding. Recent notable deals include Google's $150 million partnership with Warby Parker for AI-powered smart glasses development, with $75 million allocated specifically for co-development activities. Meta Platforms' defense sector expansion includes a $100 million partnership with Anduril for U.S. defense XR deployments, while enterprise-focused companies like ArborXR successfully raised $12 million in Series A funding while simultaneously acquiring competitor InformXR.

Key Statistics - 2025 Major Partnerships:

Google LLC + Warby Parker: $150M AI-powered smart glasses ($75M co-development)

Meta Platforms + Anduril: $100M U.S. defense XR deployments

ArborXR Series A: $12M + InformXR acquisition

Regional Market Analysis

Regional market dynamics reveal significant variations in adoption patterns, government support, and competitive positioning across major geographic markets. While North America maintains leadership in absolute spatial computing market size and venture capital activity, Asia-Pacific demonstrates the strongest growth rates driven by manufacturing capabilities, government initiatives, and rapidly expanding consumer markets.

Geographic Distribution

North America continues to lead global XR markets in terms of absolute revenue and market share, holding between 27.8% and 35.53% of global market value depending on measurement methodology. The United States alone is projected to generate $12.57 billion in AR/VR revenue during 2025, supported by strong venture capital ecosystems, significant defense spending, and the presence of major technology companies driving both innovation and adoption.

Key Statistics - North America (2024):

Market share: 27.8%-35.53%

U.S. leads with $12.57 billion projected 2025 revenue

Strong VC ecosystem and defense spending

Asia-Pacific has emerged as the fastest-growing regional market, with compound annual growth rates of 35.1% projected through 2030. The region's XR market is expected to expand from $28.46 billion in 2024 to $238.37 billion by 2032, representing a 30.43% CAGR. This growth is driven by China's role as a major manufacturer and distributor of XR hardware, Japan's technological innovation capabilities, and broad-based government support for digital transformation initiatives across multiple countries.

Key Statistics - Asia-Pacific:

Fastest growing region: 35.1% CAGR through 2030

2024: $28.46 billion, 2032 projection: $238.37 billion (30.43% CAGR)

Led by China's manufacturing and Japan's tech innovation

Government support through policy initiatives

China specifically plays a crucial role as both a major consumer market and the dominant supplier of XR hardware components. The Chinese government has designated XR among "future industries" and provides provincial R&D grants supporting ecosystem development. This combination of manufacturing scale, domestic market potential, and policy support positions China as a critical driver of global XR market growth.

Key Statistics - China Specific:

Major distributor of HMDs and VR hardware

Government designates XR among future industries

Provincial R&D grants supporting ecosystem development

Japan represents a unique market dynamic within Asia-Pacific, combining advanced technological infrastructure with strong gaming culture and increasing healthcare adoption. The country is expected to achieve the fastest growth rate within the Asia-Pacific VR market during the forecast period, supported by 5G infrastructure deployment that enables AR/VR platforms and applications.

Key Statistics - Japan:

Expected fastest growth in APAC VR market

Advanced gaming culture and healthcare adoption

5G infrastructure supporting AR/VR platforms

Market Penetration Rates

Global adoption patterns reveal significant regional variations, with Europe showing particularly strong growth momentum. The European AR and VR market is projected to expand from $2.8 billion in 2021 to $20.9 billion in 2025. VR/AR technology is expected to enhance over 400,000 jobs in Germany and the UK by 2030, while the European AR software market is forecast to reach $3.8 billion by 2027.

Key Statistics - European Market Growth:

European AR/VR market: $2.8B (2021) → $20.9B (2025)

400,000 jobs to be enhanced in Germany/UK by 2030

European AR software market: $3.8B projected by 2027

AR gaming segment in Europe: $1.8B projected by 2027

United States consumer adoption provides insight into mature market dynamics, with 48% of U.S. consumers having experienced VR technology and 13% of households owning VR headsets. Usage patterns among existing owners show strong engagement, with 88% of VR headset owners using their devices multiple times monthly and 60% using VR more than once weekly. Demographic analysis reveals that VR adoption is strongest among younger consumers, with 35% of 25-34 year-olds having used VR technology.

Key Statistics - U.S. Consumer Adoption:

48% of U.S. consumers have VR experience

13% of U.S. households own VR headset

88% of VR owners use device multiple times monthly

60% use it more than once weekly

30% bought VR device "to see what the hype was about"

35% of 25-34 year-olds have used VR technology

As spatial computing and XR continues to transform industries and consumer experiences alike, understanding the latest user engagement and market penetration statistics is essential. The following key statistics highlight the rapid growth, adoption patterns, and economic impact shaping the future of AR, VR, MR, metaverse and XR technologies.

Key Statistics - Global User Statistics:

AR/VR user penetration expected to reach 56.5% by 2029

Expected users: 3.728 billion by 2029

Average revenue per user (ARPU): $13.3

Industry Applications & Use Cases

Spatial computing applications span every major industry vertical, with adoption patterns revealing distinct preferences between consumer entertainment uses and enterprise productivity applications. Current deployment data shows clear differentiation between sectors that have achieved user adoption versus those still in experimental or pilot phases.

Primary Application Areas

Gaming maintains its position as the dominant application for VR technology, with 70% of VR headset users playing games on their devices. However, VR applications have diversified significantly beyond entertainment, with 42% of device owners using VR to watch films or TV, 35% utilizing it for workouts or exercise, and 22% leveraging VR for creative endeavors like music, video, or art creation.

Key Statistics - Usage Distribution:

Gaming: 70% of VR headset users

Films/TV watching: 42% of VR device owners

Workouts/exercise: 35% of VR headset owners

Creative activities: 22% use for music, video, art creation

Healthcare: 41% of VR devices

Education: 41% of VR devices

Entertainment and gaming continue driving consumer adoption and revenue generation, retaining 38.3% of total market revenue in 2024. The XR gaming market alone reached $18 billion by 2023, supported by expanding VR arcades and location-based entertainment venues that provide high-end experiences without requiring personal device ownership. This sector benefits from continuous content development and social gaming features that encourage sustained user engagement.

Key Statistics - Entertainment & Gaming:

Entertainment & Gaming are the leading category with 38.3% of 2024 revenue

XR gaming market: $18 billion by 2023

VR arcades and location-based entertainment growing

Healthcare sector represents the fastest-growing vertical application with a projected 33.9% CAGR, driven by proven clinical outcomes and measurable cost reductions. The healthcare XR market is projected to triple by 2030, supported by clinical case studies demonstrating 50% reduction in patient pain scores while generating $200,000 monthly cost savings through reduced medication requirements.

Key Statistics - Healthcare Growth:

Healthcare is the fastest growing enterprise vertical: 33.9% CAGR

Healthcare XR market size to triple by 2030

50% reduction in pain scores

$200,000 monthly savings in pain medication costs

Emerging Applications

Real estate applications demonstrate significant consumer interest and practical utility, with projects of the VR/AR real estate market will reach $80 billion by 2025. Approximately 1.4 million registered real estate agents currently utilize VR technology for client presentations, while survey data shows 40.4% of apartment buyers are influenced by panoramic tours, with 72.7% providing positive feedback on VR tour experiences.

Key Statistics - Real Estate:

Estimated $80 billion VR/AR real estate market value by 2025

1.4 million registered agents using VR technology

40.4% of apartment buyers influenced by panoramic tours

72.7% positive feedback on VR tours

Retail and e-commerce applications show strong consumer adoption with measurable business impact. Approximately 100 million shoppers used AR technology in 2020, with implementations showing reduced return rates through AR try-on experiences and virtual showrooms achieving higher basket sizes compared to traditional e-commerce. These applications benefit from smartphone-based AR accessibility, eliminating the need for specialized hardware.

Key Statistics - Retail & E-commerce:

100 million shoppers used AR in 2020

Reduced return rates with AR try-on experiences

Virtual showrooms achieving basket-size uplifts

Job Market & Economic Impact

The spatial computing (XR) industry demonstrates strong employment growth and competitive compensation. VR developers in the United States earn an average salary of $108,471 per year, while job postings for AR/VR roles have increased 154% over the past five years. Meta's Reality Labs division alone generated $2 billion in revenue from Quest headsets and related services, while the company has sold more than 20 million Quest VR headsets cumulatively.

Employment Projections

The United States is positioned to lead global job creation in spatial computing, with projections indicating 2.32 million AR/VR jobs by 2030. This represents extraordinary growth from a 2019 baseline of just 800,000 jobs globally, suggesting a potential 2,775% expansion over the decade. International projections are even more ambitious, with industry analysts forecasting 23 million XR-related jobs worldwide by 2030, spanning roles from content creators and experience designers to specialized technicians and enterprise implementation consultants.

Key Statistics - Job Creation:

2.32 million AR/VR jobs projected in U.S. by 2030

Global projection: 23 million jobs by 2030

2019 baseline: 800,000 jobs (2,775% growth potential)

Average VR developer salary in U.S.: $108,471 per year

154% increase in AR/VR job postings over past 5 years

2.32 million AR/VR jobs projected in U.S. by 2030

Economic Value Creation

Virtual reality's contribution to global economic value demonstrates the technology's transformation from an emerging technology to significant economic driver. VR added $13.5 billion to the global economy in 2022, with projections indicating growth to $138.3 billion by 2025. The most ambitious forecasts suggest combined AR and VR technologies could contribute $1.59 trillion to global economic output by 2030, with AR alone accounting for $1.09 trillion and VR contributing $450.5 billion.

Key Statistics - Economic Value:

2022: VR added $13.5 billion to global economy

2025: Projected $138.3 billion contribution

2030: Combined AR/VR projected $1.59 trillion boost

AR alone: $1.09 trillion, VR: $450.5 billion

Meta Reality Labs: $2B revenue from Quest ecosystem

Meta has sold >20 million Meta Quest headsets cumulatively

Industry Impact by Sector

Beyond gaming applications, XR technologies demonstrate significant productivity improvements across key economic sectors. Workforce development leads growth applications with 24% annual expansion, followed by manufacturing at 21%, automotive at 19%, and marketing/advertising at 16%. Engineering applications show particularly strong efficiency gains, with 10% reductions in time-to-market and 7% decreases in construction time, demonstrating concrete business value that justifies enterprise investment.

Key Statistics - Key Growth Sectors (Beyond Gaming):

Workforce development: 24% growth rate

Manufacturing: 21% growth rate

Automotive: 19% growth rate

Marketing/Advertising: 16% growth rate

Engineering: 10% time-to-market reduction, 7% construction time decrease

Industry Competitive Landscape

The spatial computing (XR) industry competitive landscape reflects a complex ecosystem where established technology giants compete alongside specialized studios and product startups, with success increasingly depending on vertical market expertise and integrated platform strategies rather than hardware specifications alone. For a full analysis of the leading companies in the industry see: Best Augmented Reality Companies 2025 and Best Virtual Reality Companies 2025.

Leading Hardware Companies

Meta

Meta maintains the dominant market position through its vertically integrated ecosystem approach, combining proprietary silicon development with the Horizon OS platform and integrated app store. The company's strategy of heavy R&D investment despite sustained operating losses demonstrates long-term commitment to platform dominance, though recent market share fluctuations suggest increasing competitive pressure from new entry competitors.

Dominant market position with comprehensive ecosystem

Proprietary silicon + Horizon Operating system + app store

Meta Quest driving consumer adoption

Heavy R&D investment despite operating losses

Apple

Apple has established its premium market positioning with the Vision Pro. The company's silicon-to-services integration strategy leverages its existing ecosystem and distribution advantages, though mass market penetration remains limited by premium and early adoption positioning. Industry reports suggest Apple is developing a more accessible mainstream model targeted for 2027 release.

Premium positioning with Vision Pro

Silicon-to-services integration strategy

Targeting mainstream model by 2027

Google has re-entered the industry through the $250 million acquisition of HTC's XR assets and development of the Android XR platform in partnership with industry hardware leader MagicLeap. The company's approach emphasizes smart glasses applications and partnerships with established eyewear brands, positioning for longer-term market development as hardware form factors evolve toward mainstream acceptance.

Android XR platform development

$250M HTC XR assets acquisition

Smart glasses roadmap partnerships

Leading Software Companies

XR specialized software companies have become increasingly critical in defining the value of spatial computing by enabling enterprise adoption, integration, and scalable deployment. These firms provide the software development services that turn AR/VR hardware into valuable business solutions and consumer applications.

For more details on the leading AR/VRXR/Spatial Computing software development companies see: Top Spatial Computing Development Companies, Top Augmented Reality (AR) Development Companies and Top Virtual Reality (VR) Development Companies.

Treeview

Treeview is an established leader in AR/VR/XR/MR and spatial computing software development for enterprise companies, focusing on research-driven innovation and industry-specific applications. Treeview's approach emphasizes delivering high-quality custom applications with business value through healthcare, digital twins, training, education, and energy use cases, positioning it as a trusted partner for large-scale digital transformation.Treeview’s senior-only development model and reputation for world-class quality reinforce its role as a high-impact software player in the global XR ecosystem.

High quality XR/Spatial Computing app development, R&D and innovation

Specializes in enterprise applications

Known for delivering high-quality enterprise XR solutions globally

Accenture

Accenture has built a strong presence in spatial computing by integrating XR solutions into its broader digital transformation and workforce enablement services. Leveraging its consulting expertise and global reach, the firm helps enterprises deploy immersive training, design, and collaboration at scale. Despite challenges in balancing innovation with operational efficiency, Accenture continues to be recognized integrator for XR adoption across Fortune 500 companies.

Enterprise transformation with XR/Spatial Computing services

Focus on consulting, large-scale deployments, and workforce enablement

Specialized in XR and digital transformation consulting

Capgemini

Capgemini has developed a growing XR practice that aligns with its consulting-driven approach to digital transformation. By focusing on industry-specific integrations, the company supports clients in areas like manufacturing, retail, and energy, where immersive technologies deliver measurable ROI. Capgemini’s strength lies in its ability to bridge cutting-edge XR software with enterprise-scale deployment, though it faces increasing competition from both global consultancies and specialized XR studios.

Global consultancy with strong XR practice

Emphasizes industry-specific XR integrations

Known for large-scale digital transformation projects across multiple sectors

Emerging Leaders & Specialists

The competitive landscape increasingly rewards domain-specific expertise over generalist platform strategies. Treeview has emerged as a global leader in enterprise XR and spatial computing R&D, helping large organizations pilot and deploy next-generation immersive solutions. ManageXR delivers enterprise-grade device management and analytics to support large-scale XR deployments. Transfr specializes in immersive training and education, providing scalable XR simulations that enhance workforce readiness and career development. Felix & Paul have built a reputation as pioneers in cinematic VR storytelling and immersive entertainment experiences.

Domain-Specific Leaders:

Treeview: Enterprise XR/AR/VR/MR/Spatial Computing app development, R&D and innovation

ManageXR: Enterprise device management + analytics

Transfr: Training and Education

Felix & Paul: Entertainment and storytelling

Key Industry Resources & Links

The Augmented Reality (AR), Virtual Reality (VR), Extended Reality (XR), Mixed Reality (MR), Metaverse, and Spatial Computing Industry Statistics Report 2026 is compiled from 50+ industry sources, academic studies, market research reports, and internal research to provide centralized industry statistics and analysis. Data is current as of January 2026.

Market Research Reports

www.mordorintelligence.com/industry-reports/virtual-augmented-and-mixed-reality-market

www.mordorintelligence.com/industry-reports/extended-reality-xr-market

www.grandviewresearch.com/industry-analysis/augmented-reality-market

www.fortunebusinessinsights.com/industry-reports/virtual-reality-market-101378

www.idc.com/promo/arvr/

www.statista.com/outlook/amo/ar-vr/worldwide

www.marketresearchfuture.com/reports/ar-and-vr-in-training-market-24399

assets.ctfassets.net/0o6s67aqvwnu/1zmWdgZfYLEEbdLS2DCtNi/0b573716bd56b0a4c09aede06b4325d9/Beyond_Reality_April_2022.pdf

press.spglobal.com/2022-11-03-S-P-Global-Market-Intelligence-Outlook-Projects-AR-and-VR-Installed-Base-to-Reach-Nearly-74-Million-by-2026-as-Game-Technology-Illustrates-Promise-of-Metaverse

www.mckinsey.com/spContent/bespoke/tech-trends/pdfs/mckinsey-tech-trends-outlook-2022-immersive-reality.pdf

www.statista.com/statistics/677096/vr-headsets-worldwide/

www.statista.com/statistics/1290133/meta-reality-labs-annual-revenue/

www.grandviewresearch.com/industry-analysis/virtual-reality-vr-market

Industry Data Sources

www.counterpointresearch.com/en/insights/global-xr-ar-vr-headsets-market-share-quarterly

www.trendforce.com/presscenter/news/20241219-12419.html

www.marketresearchfuture.com/reports/ar-and-vr-in-training-market-24399

www.pwc.co.uk/services/technology/immersive-technologies/study-into-vr-training-effectiveness.html

www.pwc.com/id/en/media-centre/press-release/2020/english/virtual-and-augmented-reality-could-deliver-a-p1-4trillion-boost.html

telecomlead.com/smart-phone/global-ar-vr-headset-shipments-forecast-to-rebound-in-2024-idc-113875

www.accenture.com/content/dam/accenture/final/a-com-migration/r3-3/pdf/pdf-86/accenture-extended-reality-immersive-training.pdf

trainingmag.com/2024-training-industry-report/

9to5mac.com/2024/08/08/2500-native-vision-pro-apps/

developers.meta.com/horizon/blog/gdc-2025-opportunities-mr-vr-meta-horizon-os-multiplayer-tools/

www.essilorluxottica.com/en/newsroom/press-releases/q2-h1-2025-results/

www.electronicsweekly.com/news/business/860228-2025-03/

www.idc.com/promo/arvr/

https://bestinxr.com/blog/best-xr-venture-capital-investors-vcs-funding-ar-vr-and-spatial-computing/

https://bestinxr.com/blog/top-vr-ar-and-xr-press-and-news-sites/

https://bestinxr.com/blog/best-xr-trade-shows-expos-events-and-conferences/

www.pwc.com/us/en/tech-effect/emerging-tech/virtual-reality-study.html

www.imarcgroup.com/virtual-reality-headset-market

www.globenewswire.com/en/news-release/2022/09/29/2525530/0/en/Aviation-Augmented-and-Virtual-Reality-Market-to-Reach-23-6-Billion-by-2031-Allied-Market-Research.html

transfrinc.com/efficacy-studies/effects-of-vr-on-learning-ec-tasks/

transfrinc.com/is-vr-training-effective/

transfrinc.com/understanding-vr-effectiveness-research-studies/

transfrinc.com/resources/efficacy-studies/vr-oil-change-training-shows-better-learning-gain-than-video/

www.businesswire.com/news/home/20240625623347/en/Transfrs-VR-Simulations-Boost-Learning-Gains-in-Healthcare-Training

https://financesonline.com/virtual-reality-statistics/

https://www.meta.com/emerging-tech/

Academic Research Studies

www.sciencedirect.com/science/article/pii/S294967802200006X

educationaltechnologyjournal.springeropen.com/articles/10.1186/s41239-022-00349-3

www.researchgate.net/publication/373157641_The_Effectiveness_of_Virtual_Reality_Training_A_Systematic_Review

link.springer.com/article/10.1007/s10055-023-00843-7

www.frontiersin.org/journals/virtual-reality/articles/10.3389/frvir.2024.1402093/full

bmcmededuc.biomedcentral.com/articles/10.1186/s12909-023-04662-x

www.sciencedirect.com/science/article/pii/S294967802200006X

www.edtechinnovationhub.com/news/transfrs-vr-training-enhances-healthcare-learning-outcomes

Investment, Funding & Partnership Resources

https://news.crunchbase.com/startups/metaverse-augmented-reality-virtual-reality-investment/

https://news.crunchbase.com/venture/metaverse-ar-vr-ai-aapl-meta/

https://www.goingvc.com/post/exploring-the-ar-vr-revolution-opportunities-challenges-and-venture-capital-perspectives

https://aixr.org/insights/xr-funding-sources/

https://www.magicleap.com/newsroom/magic-leap-and-google-partnership

Regional Market Data

https://www.databridgemarketresearch.com/reports/asia-pacific-virtual-reality-market

https://www.marketdataforecast.com/market-reports/asia-pacific-virtual-reality-gaming-market

Frequently Asked Questions (FAQs)

Q1: What are the key trends in the spatial computing, AR/VR, XR, Metaverse market for 2026?

A1: The XR market in 2026 is defined by the mainstream rise of smart glasses, deeper integration of artificial intelligence, and rapid improvements in display technology. Consumer-friendly devices like Meta’s Ray-Ban Smart Glasses signal growing demand for stylish wearables, while AI is making XR experiences more intuitive through real-time object recognition, gesture control, and generative content. At the same time, advances in micro-LED displays and waveguide optics are enabling lighter, more immersive headsets. Together with expanding use cases in healthcare, training, and gaming, these trends highlight XR’s transition from niche innovation to a central technology shaping both enterprise and consumer markets.

Q2: Which companies hold a significant share in the spatial computing, XR, AR/VR, Metaverse industry?

A2: Major players in the spatial computing industry can be grouped into hardware, software, and specialized solution providers. On the hardware side, companies such as Meta, Apple, and Google drive device innovation with headsets and smart glasses. In software development, firms like Treeview, Accenture, and Capgemini play a central role in building applications, platforms, and enterprise solutions. Specialized leaders including Treeview, ManageXR, Transfr, and Felix & Paul Studios focus on domain-specific use cases such as enterprise XR research, device management, immersive training, and cinematic VR storytelling, helping shape the broader XR ecosystem.

Q3: What types of consulting and deployment services are available in spatial computing, XR, AR/VR and Metaverse?

A3: Consulting and development services in spatial computing, XR, AR/VR and metaverse typically cover the full lifecycle of immersive solutions. They include discovery and consulting, spatial product design, 3D content creation, custom software development, and ongoing support. These services help organizations align XR strategies with business objectives, integrate spatial technologies into existing systems, and design applications tailored to industry needs. Deployment services focus on system installation, device and software integration, training, and managed services, ensuring reliable operation and long-term optimization of spatial computing implementations.

Q4: How does spatial computing, XR and AR/VR provide a competitive edge to businesses?

A4: Spatial computing (XR) offers a competitive edge by enabling immersive and interactive experiences that enhance productivity, training efficiency, and customer engagement. The use of advanced sensors and digital worlds allows businesses to streamline operations, reduce costs, and innovate across various industries such as healthcare, manufacturing, and retail.

Q5: What are the concerns regarding sensitive data in XR?

A5: With the extensive use of spatial computing solutions, concerns around sensitive data privacy and security have become paramount. Companies are increasingly investing in encryption, secure cloud infrastructure, and privacy-enhancing technologies to protect user data and comply with regulatory requirements while maintaining trust in spatial computing applications.

Q6: What is the significance of the AR VR MR XR spatial computing statistics industry report 2026?

A6: The AR VR MR XR spatial computing statistics industry report 2026 provides a complete overview of insights into market size, growth trends, technology adoption, and competitive landscape. It helps stakeholders understand the evolving dynamics of spatial computing technologies, including augmented reality (AR), virtual reality (VR), mixed reality (MR), and extended reality (XR), enabling informed decision-making and strategic planning.

Q7: How do AR devices contribute to the growth of the spatial computing market?

A7: AR devices such as smart glasses and headsets play a crucial role in expanding spatial computing and XR applications by overlaying digital content onto the physical world. These devices enhance user interaction with digital and physical environments, driving enterprise adoption, improving training, and enabling innovative use cases across industries like healthcare, manufacturing, and retail.

Q8: What role does modeling software play in spatial computing solutions?

A8: Modeling software is essential for creating and manipulating 3D digital content within spatial computing environments. It enables developers and designers to build accurate, interactive models used in augmented reality, virtual reality, and mixed reality applications, facilitating realistic simulations, digital twins, and immersive experiences that bridge the digital and physical worlds.

Q9: How is edge computing impacting the spatial computing industry?

A9: Edge computing enhances spatial computing by processing data closer to the user or device, reducing latency and enabling real-time interactions. This technological advancement supports complex spatial mapping, AI-driven analytics, and cloud computing integration, contributing to smoother, more responsive immersive experiences and expanding the potential for enterprise applications.

Q11: How does the spatial computing industry address concerns around sensitive data?

A11: The industry prioritizes data privacy and security by implementing encryption, secure cloud infrastructure, and privacy-enhancing technologies. Compliance with regulatory standards and transparent data management practices help build user trust while enabling the safe use of spatial computing solutions across sensitive sectors like healthcare and defense.

Q12: What is the regional outlook for the spatial computing market, particularly in North America and the Middle East and Asia?

A12: North America leads the global spatial computing market with strong enterprise adoption, technological innovation, and a robust software ecosystem. The Middle East and Asia region is emerging rapidly, supported by government initiatives and growing demand for immersive technologies. Both regions contribute significantly to the market’s expansion through investments in hardware, software, and managed services.

Q13: Which companies are major players in the spatial computing industry?

A13: Leading companies include Microsoft Corporation, Meta Platforms, Apple Inc., Google LLC, Treeview, ManageXR, Transfr, Sony Corporation, Lenovo Group Limited, Magic Leap, and Unity Technologies. These organizations drive innovation in spatial computing hardware, software ecosystems, consulting services, and deployment services, shaping the competitive landscape.

Q14: How do consulting and deployment services support spatial computing market growth?

A14: Consulting services provide strategic guidance, technology integration, and customized solutions tailored to business needs. Deployment services encompass system installation, integration of spatial computing devices and software, training, and managed services. Together, they ensure successful implementation and optimization of spatial computing solutions, accelerating market adoption.

Q15: What are digital twins and how are they related to spatial computing?

A15: Digital twins are virtual replicas of physical assets or environments created using spatial computing technologies. They enable real-time monitoring, simulation, and analysis, enhancing design, manufacturing, and maintenance processes. Digital twins exemplify the seamless integration of digital and physical worlds, a core principle of spatial computing.